A complex, and sometimes confusing system, property taxes provide cities with the dollars they need to deliver the programs and services residents depend on each day. The property tax system is based on the practice of collecting taxes based on the property values.

The process begins by determining each property's assessed value. The Municipal Property Assessment Corporation (MPAC) does this for the entire province of Ontario. Each property is assessed at its fair market value. Property values are then supplied to municipalities on annual assessment rolls. Municipalities complete the process by applying the appropriate tax rate to the assessed value of the property. Tax rates are determined annually in each municipality, and differ amongst various tax classes (i.e. residential, industrial, commercial, etc).

In Temiskaming Shores the sums raised through taxes are approximately divided as follows:

- 55% for municipal services;

- 20% for your water and sewer services; and

- 25% is forwarded to the Province for education.

IN THIS SECTION:

How Taxes Are Calculated

Understanding Your Tax Bill

Supplementary / Omitted Tax Billings

Address Changes

Tax Classes

Frequently Asked Questions

How Taxes Are Calculated

The amount of property tax payable on land and / or building is the result of a calculation based on four factors:

- The market value assessment of your property (provided by the Municipal Property Assessment Corporation (MPAC))

- The tax class into which your property falls

- The tax rate for the applicable tax class (set annually by City Council)

- The tax rate for the Education portion of that class (set annually by the Province of Ontario)

Property taxes are calculated using the Current Value Assessment of a property and multiplying it by the combined municipal and education tax rates for the applicable class of property.

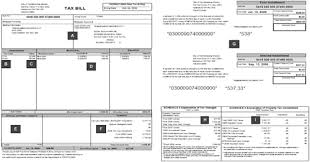

A - Property Identification: This section contains the identification information of your property. The information includes: roll number, group code (use for people with multiple properties), mortgage company and mortgage number (if your taxes are paid on behalf of you mortgage company), owner's name and mailing address and the property location and description.

B - Tax Class: This section lists the classification(s) of your property. The tax class codes are broken down by class, qualifier & education support. The class codes are either 3 or 4 alpha and/or numeric codes. These classifications are assigned by MPAC. Should you have a question regarding the classification you are encouraged to contact MPAC at 1-866-296-6722.

C - Value: This shows the current value of your property as assessed by the Municipal Property Assessment Corporation (MPAC).

D - Municipal/ Education Rates & Levies: This section provides a breakdown of your property taxes. The municipal tax rates are set by City Council while the Education Tax rates are set by the Province. The rates are multiplied by your assessment to provide the breakdown for each levy.

E - Special Charges / Credits: This section will list any charges or credits that are specific to your property. The charges could include local improvement charges such as water and sewer charges.

F - Summary: This section summarizes your total taxes levied (both municipal and education), your total special charges and credits and any capping adjustments (applicable only for commercial, industrial and multi-residential properties). The total amount due for your billing is also noted in this area. Information on the total yearly taxes can also be found in this section.

G- Payment Stubs: Payment stubs are to be submitted along with your payment. Payment can be made by mail, in person, at your financial institutions or via telephone banking or internet banking. If you are paying your taxes using the City's Pre-authorized Payment plans or your mortgage company is paying your taxes on your behalf, these stubs will not have any payments due and payable on them. They will indicate that you do not need to pay the bill and to keep the bill for income tax purposes.

H - Schedule 2: This area is used for Residential, Farm, Managed Forest and Pipeline properties. It shows the year over year change from the previous year to the current year comprised strictly to the actual taxes, excluding any special charges or credits. It further breaks down the difference in the municipal and education levy change.

I - Schedule 3: This area is used for the Commercial, Industrial and Multi-Residential property classes. It shows the current year's taxes levied amount and the current year's adjusted tax levied amount due to the provincially mandated capping program. It further breaks down the difference in the tax cap amount, municipal levy change and the education levy change.

Supplementary / Omitted Tax Billings

What is a Supplementary Assessment?

A supplementary assessment is an additional (increase in value) resulting from property improvements or changes, which were not reflected in the property tax bill for the current year and occurred after the return of the assessment roll. A supplementary assessment can be processed for the following reasons:

- There is an increase in property value because of a new building or improvement.

- A property ceases to be exempt from taxation or ceases to be eligible for assessment at the farm value, managed forest, or conservation lands;

- A property ceases to be classified in a subclass of real property, farmlands awaiting development, commercial or industrial vacant land;

- A property becomes liable for taxation in a different property class.

What is an Omitted Assessment?

An omitted assessment is an additional assessment resulting from building a new home or addition, which was not previously recorded on the annual assessment roll. An omitted assessment can be processed for the current year and two preceding years for the following reasons:

- There is an increase in property value because of a new building or improvement;

- To assess and classify land that was previously exempt;

- A property ceases to be classified as managed forest or conservation land.

How does the Supplementary / Omitted Assessment Work?

When the City issues a building permit, there will most likely be a value change in the property, which creates a supplementary/omitted assessment. Your property assessment will need to be updated to reflect the completed work as a result of the building permit. The Municipal Property Assessment Corporation (MPAC) will mail you a supplementary or omitted assessment notice.

What is a Supplementary / Omitted Tax Bill?

For taxation purposes, you will receive a tax bill at a later date called a "supplementary" tax bill. The supplementary tax bill will reflect the additional change in your assessment and taxes owing will be adjusted accordingly.

If the supplementary/omitted tax bill is for a new home, you, as the owner, will be responsible from the effective date of occupancy and/or possession; therefore, creating multiple year supplementary/omitted tax bills.

How is a Supplementary Tax Bill Calculated?

Supplementary tax is determined by multiplying the supplementary assessment (increase in value) by the tax rate and prorating this amount based on the number of days the building has been completed or occupied for the year.

Does this Notice Mean that My Property Taxes will Go Up?

If the supplementary notice is for additions or improvements to your property, yes, your taxes will increase. Not forgetting that your land may have been previously assessed, your supplementary/omitted tax bill will only be for the structure portion of the property.

If your supplementary notice is only for a change in classification, the municipality applies a new tax rate to your property. The new tax rate could be higher or lower than what was previously billed.

When Must the Supplementary Tax Bill be Paid?

The bill must be paid by the due date indicated on your tax bill. The Municipality must provide 21 days notice from the date issued to the due date. Additional assessment occurring from building a new home or addition can result in a supplementary tax bill that can amount to thousands of dollars. Plan for this billing as soon as you start work on your property by putting money aside on a monthly basis to pay the bill when it comes due. The Property Tax Calculator can assist you in calculating how much yearly tax to expect. Remember, you only have 21 days from the billing date to pay the supplementary tax bill.

Note: If you are enrolled in the City's Pre-Authorized Payment Plan, any supplementary tax bill issued must be paid separately by the due date indicated on your tax bill, unless notified differently by our office.

In order for the City of Temiskaming Shores to maintain an accurate and up to date database for property taxes, we must receive notification of any mailing address changes.

Please note, it is the responsibility of the property owner to notify the tax department of any changes that affect their mailing addresses. Failure to receive a tax bill does not absolve a taxpayer from responsibility for payment of taxes or penalty / interest charges.

Should you require an address change on your property please notify us by:

Mail:

City of Temiskaming Shores

P.O. Box 2050, 325 Farr Drive

Haileybury, Ontario P0J 1K0

P: 705-672-3363

F: 705-672-3200

Email: finance@temiskamingshores.ca

All properties in Ontario are assigned property tax classifications by MPAC. The classifications are 3 or 4 alpha/numeric codes and each letter / number has a specific meaning.

- The first letter in your tax class = Realty Tax Class

- The second letter (or number) in your tax class = Realty Tax Qualifier

- The third and or fourth letters in your tax class = Realty Education Qualifier

|

Classifications, Qualifiers and Education Codes Used for the City of Temiskaming Shores |

|

|

REDSIDENTIAL |

|

| RTEP | Residential, Taxable, English, Public Support |

| RTES | Residential, Taxable, English, Separate Support |

| RTFP | Residential, Taxable, French, Public Support |

|

RTFS |

Residential, Taxable, French, Separate Support |

|

MULTI-RESIDENTIAL |

|

| MTEP | Multi-Residential, Taxable, English, Public Support |

| MTES | Multi-Residential, Taxable, English, Separate Support |

| MTFP | Multi-Residential, Taxable, French, Public Support |

|

MTFS |

Multi-Residential, Taxable, French, Separate Support |

|

FARMLAND |

|

| FTEP | Farmland, Taxable, English, Public Support |

| FTES | Farmland, Taxable, English, Separate Support |

| FTFP | Farmland, Taxable, French, Public Support |

|

FTFS |

Farmland, Taxable, French, Separate Support |

|

COMMERCIAL |

|

| CTN | Commercial, Taxable, No Support |

| CUN | Commercial, Taxable: Excess Land, No Support |

| CXN | Commercial, Taxable: Vacant Land, No Support |

| STN | Shopping Centre, Taxable, No Support |

|

SUN |

Shopping Centre, Taxable: Excess Land, No Support |

|

INDUSTRIAL |

|

| ITN | Industrial, Taxable, No Support |

| IUN | Industrial, Taxable: Excess Land, No Support |

|

IXN |

Industrial, Taxable: Vacant Land, No Support |

|

MANAGED FOREST |

|

| TTEP | Managed Forest, Taxable, English, Public Support |

| TTES | Managed Forest, Taxable, English, Separate Support |

| TTFP | Managed Forest, Taxable, French, Public Support |

|

TTFS |

Managed Forest, Taxable, French, Separate Support |

|

PIPELINES |

|

| PTN | Pipeline, Taxable, No Support |

Frequently Asked Questions

View a comprehensive list of Taxation FAQ.

Subscribe to this page

Subscribe to this page