The City of Temiskaming Shores tax department operates within the Finance Services division and is responsible for the billing and collection of all interim, final, and supplementary property tax billings. The tax department also administers a number of provincially mandated programs including the commercial vacancy rebate and the registered charity rebate programs. The department also processes property tax adjustments resulting from Section 357 applications under the Municipal Act, assessment review board decisions, and requests for reconsideration under the authority of the Assessment Act.

By-law No. 2019-013 - Municipal Property Tax Policy

General Information

Tax Certificates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The City of Temiskaming Shores under the Freedom of Information Act cannot release tax information to the public without a formal request for a Property Information Certificate. A written request must be submitted to our office along with a payment in the amount of $150.00 per roll number. Once the information has been processed, we forward the certificate either by fax or by mail. All requests must be received a minimum of 5 days before the required deadline to allow staff sufficient time to prepare the information package. Please send your requests to |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Sales |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If property taxes remain unpaid for a specific period of time, the Municipal Act provides for the sale of the property. The City registers a Tax Arrears Certificate if taxes remain unpaid on a property for any part of two years prior to January 1st of any year. These timelines apply to all property classes. A Tax Arrears Certificate indicates that the property will be sold if taxes, penalties and reasonable costs incurred by the City are not paid within one year of registration of the certificate. Once the certificate has been registered, partial payments cannot be accepted, but a Council approved repayment schedule may be arranged with the owner prior to the expiry of the one-year period. Properties currently available through tax sales are posted on the Public Notices section of the website (ad and applicable mapping). The City will advertise the property for sale for non-payment of taxes if the cancellation price is not paid within one year following registration of the certificate. Advertisements are generally published in the Temiskaming Speaker for four consecutive weeks and the Ontario Gazette for one week. Using forms provided by the tax office, the bid plus a certified cheque for 20% of the tendered amount must be submitted in a sealed envelope prior to the specified time. To be eligible, bids must be at least equal to the advertised minimum tender amount. The successful purchasers will be required to pay the amount tendered plus accumulated taxes, penalties and interest, and the relevant land transfer tax. From the day of notification to the highest bidder, this eligible bidder has 14 days to complete the transaction. All tax properties are sold without warranty and are sold as is. Further information will be made available at the time of advertising of the properties. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Calculation |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

A complex, and sometimes confusing system, property taxes provide cities with the dollars they need to deliver the programs and services residents depend on each day. The property tax system is based on the practice of collecting taxes based on the property values. The process begins by determining each property's assessed value. The Municipal Property Assessment Corporation (MPAC) does this for the entire province of Ontario. Each property is assessed at its fair market value. Property values are then supplied to municipalities on annual assessment rolls. Municipalities complete the process by applying the appropriate tax rate to the assessed value of the property. Tax rates are determined annually in each municipality, and differ amongst various tax classes (i.e. residential, industrial, commercial, etc). In Temiskaming Shores the sums raised through taxes are approximately divided as follows:

How Taxes are calculatedThe amount of property tax payable on land and / or building is the result of a calculation based on four factors:

Property taxes are calculated using the Current Value Assessment of a property and multiplying it by the combined municipal and education tax rates for the applicable class of property. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

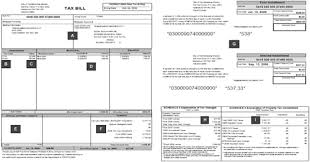

Understanding Your Tax Bill |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Classifications |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

All properties in Ontario are assigned property tax classifications by MPAC. The classifications are 3 or 4 alpha/numeric codes and each letter / number has a specific meaning.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Account Address Changes |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In order for the City of Temiskaming Shores to maintain an accurate and up to date database for property taxes, we must receive notification of any mailing address changes. Please note, it is the responsibility of the property owner to notify the tax department of any changes that affect their mailing addresses. Failure to receive a tax bill does not absolve a taxpayer from responsibility for payment of taxes or penalty / interest charges. Should you require an address change on your property please notify us by: Mail | City of Temiskaming Shores, P.O. Box 2050, 325 Farr Drive, Haileybury, Ontario P0J 1K0 |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Account Name Change |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Our tax system must match the information as registered at the Land Registry Office. These changes must therefore be made at the Registry's office beforehand. A copy of the completed change on the prescribed form must then be submitted to the City for our records. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Rates |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forms |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pre-Authorized Payment Plan Application

Senior or Low Income Deferral Application School Board Direction Application |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tax Payments

Due Dates |

| Property tax bills are mailed twice a year.

Interim Tax Bill (first bill) which is mailed mid-February with two installments due dates:

Final Tax Bill (second bill) which is mailed in mid-June with two installments due dates:

Please note if the 15th day of the month falls on a weekend, the tax due date will move up to the following business day. |

Penalty and Interest |

|

In accordance with the City of Temiskaming Shores tax levy by-laws, a penalty /interest charge of 1.25% is applied to overdue amounts. Payment Application RulesProperty tax payments received are applied first to any penalties or interest owing (oldest year first), and then to taxes owing starting with the oldest year. These rules apply to all property tax payments received and cannot be altered. |

Tax Arrears |

|

Notice of Tax Arrears are mailed to property owners in arrears advising that their property taxes are overdue. These statements are mailed:

|

Tax Receipts |

|

All taxpayers may receive a receipt, free of charge, at the time of payment by providing the office with a self-addressed stamped envelope or by attending City Hall located at 325 Farr Drive. Taxpayers must now pay a fee of $10.00 in order to receive a formal receipt for income tax purposes, reprint of their tax bill, or any other information which appears on the final tax bill. |

Payment Options |

|

Note | Cheque must be made payable to the City of Temiskaming Shores. We do accept post dates cheques for all payments. In PersonAt the City of Temiskaming Shores municipal Office located at 325 Farr Drive, open Monday to Friday 8:30 a.m. to 4:30 p.m.

Drop-off BoxesPayments can also be left in our drop off boxes located at:

By MailSend to the City of Temiskaming Shores, P.O. Box 2050, Haileybury, ON, P0J 1K0.

Internet / TelebankingTax payments may be made through internet banking or telebanking. You must first set up your account using the portion of your roll number as highlighted below. 5418 "000 000 00000 0000" Financial InstitutionsPayments may be made at most local banks and caisses populaires on or before the due date. Taxpayers are required to present their tax bill at the time of payment. The financial institution may charge a fee for this service. Mortgage CompanyMortgage companies may provide a service to pay property taxes as part of your monthly mortgage installment. Please inquire with your mortgage company. |

Payment Option - Pre-Authorization Payment Plan (PAP) |

Benefits of the PAP plan

Option #1 - MonthlyYour taxes will be automatically withdrawn from your bank account in eleven payments on the last business day of each month starting in January of each year. December is kept as an adjustment month, if need be. A letter is sent to you advising you of any changes to your monthly installments. At that time we also send a copy of the Final Tax Bill for income tax purposes. Option #2 - InstallmentA copy of the Tax Bill is forwarded for your information on the amount of each installment and their due dates. On the due date, the tax installment will automatically be withdrawn from your bank account. How Do You Enroll?If you own property in the City of Temiskaming Shores and have no outstanding taxes, you can enroll in this payment plan. All you need to do is complete the Pre-authorized Payment Plan Application and send it to our office along with a void cheque. The payment plan remains active until such time as the property is sold, or we are advised to cancel the plan. Withdrawal or Information ChangeIf you have information changes or wish to withdraw from the PAP plan, please notify the Tax Department fifteen (15) days prior to the scheduled payment date. View or print a copy of the Application form. |

Tax Rebate and Relief Programs

Vacancy Rebate |

|

Section 364 of the Municipal Act, 2001 provides for rebates to vacant business units at the same percentage as discounts afforded to property owners of vacant and excess land. These percentages are 10% for commercial properties and 15% for industrial properties for the 2024 taxation year. Property owners who are eligible for a rebate must submit an application to the municipality each year that a building, or portion of a building, is vacant. The deadline to submit an application for a tax year is February 28th of the following year. Eligible ApplicantsTo be eligible for a rebate, a building or portion of a building must satisfy the following:

View or print a copy of the Application form. |

Charitable Rebate |

|

Under Section 361(1) of the Municipal Act, 2001, every municipality shall have a tax rebate program for eligible charities for the purpose of giving them relief from taxes on eligible property they occupy. The program is applicable to registered charities that are tenants in a commercial or industrial class property. The landlord may be contacted by the charity to provide certain information that the City requires in order to process their application. Deadline for the current year is February 28th of the following year. The minimum percentage prescribed for the calculation of a rebate is 40%. Registered charities must apply every year for the rebate by completing an application and returning to the City of Temiskaming Shores taxation department. View or print a copy of the Application form. Tax Relief Application for Registered Charitable Organizations |

Tax Relief for Eligible Low Income Seniors and Disabled Persons |

Under Section 319(1) of the Municipal Act, 2001, a municipality shall pass a by-law with the purpose of relieving the financial hardship through the provision of tax relief to eligible low income seniors and low income disabled persons for assessment related tax increases on property in the residential/farmland property class.

Eligible Applicant

Form of Tax Relief

Repayment of Tax Relief (Deferral)

Amount of Tax Relief (Deferral)

Application Process

View or print a copy of the Application form. |

Supplementary / Omitted Tax Billings

About |

|

For taxation purposes, you will receive a tax bill at a later date called a "supplementary" tax bill. The supplementary tax bill will reflect the additional change in your assessment and taxes owing will be adjusted accordingly. If the supplementary/omitted tax bill is for a new home, you, as the owner, will be responsible from the effective date of occupancy and/or possession; therefore, creating multiple year supplementary/omitted tax bills. How does the Supplementary / Omitted Assessment Work?When the City issues a building permit, there will most likely be a value change in the property, which creates a supplementary/omitted assessment. Your property assessment will need to be updated to reflect the completed work as a result of the building permit. The Municipal Property Assessment Corporation (MPAC) will mail you a supplementary or omitted assessment notice. Does this Notice Mean that My Property Taxes will Go Up?If the supplementary notice is for additions or improvements to your property, yes, your taxes will increase. Not forgetting that your land may have been previously assessed, your supplementary/omitted tax bill will only be for the structure portion of the property. If your supplementary notice is only for a change in classification, the municipality applies a new tax rate to your property. The new tax rate could be higher or lower than what was previously billed. |

Supplementary Assessment |

A supplementary assessment is an additional (increase in value) resulting from property improvements or changes, which were not reflected in the property tax bill for the current year and occurred after the return of the assessment roll. A supplementary assessment can be processed for the following reasons:

PaymentThe bill must be paid by the due date indicated on your tax bill. The Municipality must provide 21 days notice from the date issued to the due date. Additional assessment occurring from building a new home or addition can result in a supplementary tax bill that can amount to thousands of dollars. Plan for this billing as soon as you start work on your property by putting money aside on a monthly basis to pay the bill when it comes due. The Property Tax Calculator can assist you in calculating how much yearly tax to expect. Remember, you only have 21 days from the billing date to pay the supplementary tax bill. Note: If you are enrolled in the City's Pre-Authorized Payment Plan, any supplementary tax bill issued must be paid separately by the due date indicated on your tax bill, unless notified differently by our office. CalculationSupplementary tax is determined by multiplying the supplementary assessment (increase in value) by the tax rate and prorating this amount based on the number of days the building has been completed or occupied for the year. |

Omitted Assessment |

An omitted assessment is an additional assessment resulting from building a new home or addition, which was not previously recorded on the annual assessment roll. An omitted assessment can be processed for the current year and two preceding years for the following reasons:

|

Frequently Asked Questions

How do I obtain information on my property taxes? |

|

You can access a wide range of tax information through our Taxation Services section of the website, or you can contact our Taxation Department: Phone | 705-672-3363 |

I removed my swimming pool, how can I receive my tax adjustment? |

| Once you've removed your swimming pool, we require that you contact our Planning Department and make an appointment to have the building inspector come in and inspect the location to confirm that the pool has been removed. The Tax Department will then receive confirmation from the Planning Department and make all necessary adjustments from that point on. |

My house has been changed to a single unit dwelling, how can I get my water and sewer charge adjustment? |

| Once the property has been converted back into a single unit dwelling, you must contact our Planning and Development Department at 705-672-3363 and make an appointment to have someone come in and look at the property to confirm the status of the conversion. Once confirmation has been received, the Tax Department will adjust your water and sewer charges accordingly. |

If I build a garage or an extension to my house, will my taxes go up? |

| Yes, this new structure will add value to your property which in turn will increase the assessed value. The assessed value is in turn multiplied by the set tax rate which gives you your total annual taxes. |

A - Property Identification

A - Property Identification Subscribe to this page

Subscribe to this page